The global financial landscape is undergoing a seismic shift, driven by the relentless march of technology. Just as the advent of credit cards reshaped commerce in the 20th century, the digital payments revolution is poised to redefine how we transact and interact with money in the 21st century. This isn’t just about convenience; it’s about a fundamental restructuring of the international financial system, with Asia’s giants, China and India, at the forefront of this transformative wave. This financial revolution is as impactful as using a Mortgage Calculator to plan your future or tracking your assets with an Investment Tracker, making it a critical topic for anyone interested in the future of finance.

The Explosive Growth of Digital Payments

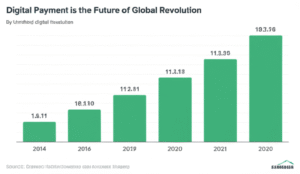

The numbers speak volumes about the momentum behind this revolution. Global digital payment volumes have witnessed exponential growth, surging from USD 1.7 trillion in 2014 to an estimated USD 18.7 trillion in 2024. Projections indicate this trajectory will continue, with the market expected to surpass USD 33 trillion by 2030. This remarkable expansion is fueled by the tangible benefits digital payments offer:

- Increased Speed and Efficiency: Transactions are faster and more streamlined compared to traditional methods.

- Reduced Costs: Lower transaction fees for both consumers and businesses.

- Improved Documentation and Security: Digital records offer enhanced transparency and security features.

- Seamless Integration: Easy compatibility with digital devices and online platforms.

Beyond these efficiencies, the digital payments revolution is fostering innovation through technologies like digital wallets, mobile payments, and potentially, central bank digital currencies (CBDCs), fundamentally altering the architecture of the financial world.

Asia Takes the Lead: China and India’s Dominance

While the shift towards digital payments is global, the Asia-Pacific (APAC) region is leading the charge, significantly outpacing North America (NA). In 2024, digital payments accounted for a staggering 81% of e-commerce transactions and 59% of point-of-sale (POS) transactions in APAC, compared to a more modest 50% and 19% in NA, respectively.

Within Asia, China and India stand out as true pioneers:

- China: Leads the world in total digital transaction value.

- India: Holds the top position in the total number of digital transactions, exceeding 89 billion real-time payments in 2022.

This dominance isn’t merely a reflection of their large populations. Both nations have actively fostered the growth of digital payments through distinct yet effective strategies.

India’s Public Infrastructure Approach

India has championed a state-driven approach, focusing on building a robust “digital public infrastructure” (DPI) under the “India Stack” umbrella. Key components include:

- Aadhar: A nationwide biometric identification system.

- Unified Payments Interface (UPI): A real-time payment system enabling seamless inter-bank transactions.

Government initiatives to expand mobile device access and bank account penetration have provided a fertile ground for the mass adoption of digital payments, with UPI becoming a ubiquitous payment method across the country.

China’s Private Sector Innovation

In contrast, China’s digital payments revolution has been largely propelled by private sector innovation. While the People’s Bank of China (PBoC) introduced a centralized clearing corporation, private payment service providers (PSPs) like Alipay and WeChat Pay have been instrumental in driving adoption and developing sophisticated payment platforms. These platforms have achieved massive scale, though concerns about “walled gardens” and data control have emerged. However, the Chinese government has recently pushed for greater interoperability between these platforms.

Table 1: Comparison of Digital Payment Adoption in APAC and NA (2024)

| Metric | Asia-Pacific (APAC) | North America (NA) |

|---|---|---|

| E-commerce Payment Share | 81% | 50% |

| Point-of-Sale Payment Share | 59% | 19% |

Graph 1: Global Digital Payment Transaction Value (USD Trillion)

Taking the Revolution Global: Exporting Models and Influence

The ambitions of China and India extend beyond their domestic markets. Both nations are actively seeking to shape the future of the global financial system by promoting their digital payment models internationally.

India’s Focus on Platform Exports

India’s strategy centers on exporting its successful UPI architecture. The government has actively engaged in government-to-government discussions to encourage other countries to adopt UPI. This has been a consistent theme in Prime Minister Modi’s foreign engagements and has been promoted in multilateral forums like the G20 and BRICS. The emphasis is on interoperability and national sovereignty in digital finance.

China’s Cross-Border Private Sector Expansion

China’s approach has seen its tech giants, Alipay and WeChat Pay, spearhead cross-border digital payments. While the government facilitates international digital payments for tourism and remittances, the primary driver has been private sector partnerships and innovation, including expansions into cross-border e-commerce. WeChat Pay, for instance, has established a significant global merchant network, supporting transactions in numerous countries and currencies.

Implications for the Future Financial Order

The contrasting approaches of China and India in the digital payments revolution have significant implications for the future global financial order:

- Alternative to Western Dominance: The rise of non-Western digital payment systems presents alternatives to traditional Western-led institutions and payment networks like SWIFT, Visa, and Mastercard.

- Geopolitical Competition: The expansion of digital payment infrastructure is increasingly intertwined with geopolitical competition, particularly in regions like the Indo-Pacific and Sub-Saharan Africa. India’s push for UPI adoption in the Pacific Islands, for example, is partly driven by concerns about China’s growing economic influence.

- Economic Security and Transparency: The dominance of private platforms in cross-border payments raises concerns about data privacy, transparency, and economic security for regulators worldwide.

- Opportunities for Developing Nations: For countries with underserved populations, digital payment systems offer a pathway to financial inclusion and economic empowerment.

- The Road Ahead: Challenges and Opportunities

The digital payments revolution is far from over. Several key trends and challenges will shape its future trajectory: - Central Bank Digital Currencies (CBDCs): Both China and India are exploring the potential of CBDCs for domestic and international use, which could further disrupt the existing financial landscape.

- Financial Crime and Sanctions Enforcement: The speed and reach of digital payments present new challenges for combating financial crime and enforcing international sanctions.

Interoperability and Standardization: Achieving greater interoperability between different digital payment systems will be crucial for seamless cross-border transactions.

Regulation and Governance: Establishing effective regulatory frameworks that foster innovation while mitigating risks will be paramount.

Frequently Asked Questions(FAQs)

What is driving the global digital payments revolution?

The revolution is driven by the benefits of speed, reduced costs, improved security, and seamless integration with digital devices, appealing to both consumers and businesses.

How are China and India leading in digital payments?

China has seen rapid growth driven by private sector giants like Alipay and WeChat Pay, while India has focused on building a state-backed digital public infrastructure (UPI) for widespread adoption.

What are the implications of this revolution for the global financial order?

It presents alternatives to Western dominance, fuels geopolitical competition, raises economic security concerns, and offers opportunities for financial inclusion in developing nations.

What are some of the challenges in the future of digital payments?

Key challenges include managing financial crime, enforcing sanctions, ensuring interoperability between systems, and establishing effective regulation.

The digital payments revolution is reshaping the global financial landscape at an unprecedented pace. China and India are not just participants but key architects of this transformation, exporting their unique models and vying for influence. For the rest of the world, particularly Western nations that have lagged in adoption, understanding and engaging with these shifts is crucial. India’s UPI model, with its emphasis on interoperability and sovereignty, presents a potential blueprint for fostering an open and secure global digital economy. As the new financial order takes shape, proactive engagement and strategic partnerships will be essential to ensure a balanced and inclusive future for global finance.